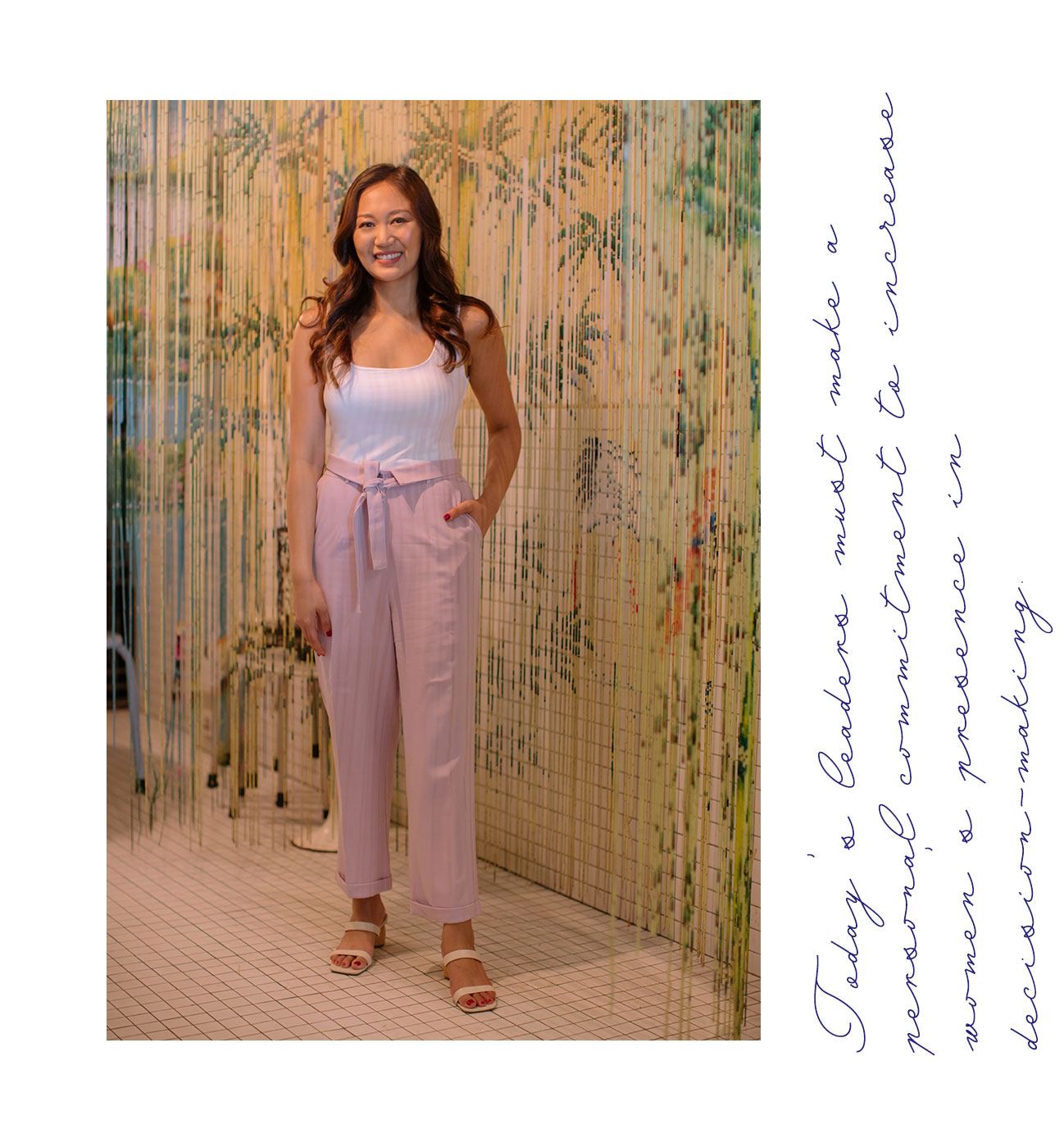

This International Women's Day, we caught up with Anna Haotanto, the founder of thenewsavvy.com, Asia's leading financial, investments and career platform for women.

Her mission to empower women to achieve financial happiness through financial literacy is one that resonates with us.

As a modern day female entrepreneur, Anna wears many hats. She is the Chief Marketing Officer of Gourmet Food Holdings, and the founding committee member of Singapore FinTech Association.

She is also the current President of Singapore Management University's Women Alumni.

Read on to find out more about Anna's journey as an entrepreneur and her thoughts on why women should be financially independent.

You founded The New Savvy, a financial, investments and career platform for women in 2015, with the mission of empowering 100 million women to achieve financial happiness.

What made you decide to place the focus on financial literacy for women? What inspired you to start up The New Savvy?

There are a few reasons for launching The New Savvy. I couldn’t ignore the desire to do this, as I’ve wanted to do it since 2010! I’ve always wanted to help people, especially women and children, and finance is the best way I know how to. I’m passionate about financial literacy and how it can transform lives. The rewards are intangible, I am happier than before.

There are 2 major inspirations for The New Savvy:

First, due to my family financial situation, I have always been fascinated with the intricacies behind the working of money. The realization that I had to take care of my family and myself sparked off my wealth-building path. The idea of making my money work harder for me really fascinated me. For me, it was a way out from living pay cheque to pay cheque and feeling very stressed every month.

I started learning how to invest by reading Security Analysis by Benjamin Graham while in Junior College. I also read a lot of other finance books. I am lucky to have the opportunity to study and work in Finance. I learnt financial management skills and started investing since I was 21. While I am no expert, I am familiar with financial products and managed to build a comfortable portfolio for myself.

Second, when I was in Hwa Chong Junior College, I did some volunteer work and noticed how many women were stuck in unhappy situations or marriages as they were not working and didn’t have any earning capabilities. That motivated me always to protect myself financially and to prevent myself from being caught in a similar situation. If proper financial knowledge and planning worked for me, it would work for many women too - which was why I started The New Savvy.

Apart from being the founder of The New Savvy, you were also the founding exco member of the Singapore Fintech Association and headed the Women in FinTech and Partnership committee. You are also the current President of the Singapore Management University's Women Alumni.

What makes you so passionate about being the voice and representative of women in each of the roles you take on?

Women have made incredible gains in the workforce over the last 20 years, our presence has nearly doubled and our median earnings have increased over 60%. Despite working, earning and saving more, women are still not investing and managing their money. Most women are savers or leave it to their spouses to manage the money.

“As a woman, I want to know how smart financial management can impact my life and how relevant it is to my needs. I want something I can relate to, something that can inspire and motivate me.” That’s what The New Savvy has been to many women. I’ve met many strangers at different events who told me that they read and LOVE The New Savvy. Many women wrote to me, sharing about their lives and financial situations. Many know the importance of acquiring financial knowledge but kept procrastinating. But when they found out about The New Savvy, they became motivated to take charge of their finances.

Are you able to share a real-life story of how your work has really impacted someone?

Once, after I gave a talk, a lady approached me and said “My dad is retrenched, my mom is sick, and my family is in dire financial situation. I need to learn how to be better at my finances. The New Savvy is exactly what I am looking for.” I literally teared in front of her. These real life encounters are my motivation when I wanted to give up. I hope to keep empowering women financially.

Why do you think it is important for women to be financially savvy?

Often, the spouse or partner who brings in the income is also the decision maker for the household. However, I would encourage women to learn about personal financial management as they are usually the person in charge of the household expenses. Equipped with the knowledge of handling finances within a household, a woman can have the ability to path a well-informed finance management plan for both her family and retirement.

How To Budget In The Simplest Way – 4 Easy Steps to Follow

According to a survey by SunTrust Bank in 2015, money troubles and financial disagreements are some of the leading causes of problems in relationships and marriages. I believe the likelihood of disagreements can be reduced if women have the same level of understanding about money management matters as their partners. How are couples supposed to handle their finances if there is only one breadwinner in the household? The best advice is to work as a team. Talk to each other and try dividing the tasks and responsibilities between yourselves. When it comes to major financial decisions in the family, make it a habit to consult each other before deciding.

International Women's Day is a global day celebrating the social, economic, cultural and political achievements of women - while also marking a call to action for accelerating gender equality. Who is a role model you look up to and why?

Being in tech, I look up to female trailblazers such as Sheryl Sandberg and Susan Wojcicki. They have changed the definition of what’s possible for women in tech. Also, my mom is the kindest person I know, and I love her deeply! She has always taught me always to be humble and be willing to learn.

International Women's Day 2020's campaign theme is #EachforEqual; an equal world is an enabled world. In what ways do you think we can contribute to create a gender-equal world?

Gender equality is achieved when women and men enjoy the same rights and opportunities across all sectors of society, including economic participation and decision-making, and when the different behaviours, aspirations and needs of women and men are equally valued and favoured.

Today’s leaders must make a personal commitment to increase women’s presence in decision-making – not just in their numbers, but in their contributions. There are many ways to do this – quotas and numerical targets for women’s participation; training and mentorship to boost women’s confidence and capacity and more. Employers must ensure equal hiring, payment and promotion policies; support to balance work-life conditions, and give women the opportunity to lead. Managers must learn to welcome women’s input and contribution.

What are some of the challenges you faced in your entrepreneurial journey?

In the beginning, I struggled a lot. My background was in Finance and Banking. I was clueless on how to develop a website, produce content, do digital marketing, and publishing. But I knew it was something I wanted to do and HAD to do. I did everything from scratch myself. I looked around for website developers and researched on websites. I did a short market survey on what is lacking regarding women financial education and what women will like to learn more. I took up a Digital Marketing course and learnt how to utilise tools like Google Analytics and Search console.

I didn’t want us to be another financial site that teaches you how to make 20x in a week. I wanted The New Savvy to be relatable to women, so they won't be intimidated by Finance. We focused on having original content that was engaging, fun and relevant. When I shared my idea with people, most of them dismissed it, thinking that it’s just another blog. Or, they thought it was limiting to focus only on women. Many told me to broaden the audience to get more website hits.

Coming from a finance background, it was difficult becoming an entrepreneur. I was giving up a good five-figure income and some people told me not to be naïve and “get a real job”. That affected my morale. For a long time, I wondered if I was just impetuous or silly. There’s a societal pressure, especially when you don’t know what’s going to happen, but I knew I was doing this mostly to help other women.

I wasn’t trained for this role. It was an uphill struggle for me. I ended up working till 4 am every day. My closed ones were concerned and told me not to overwork. I think I made every mistake that shouldn’t be made. But that’s life, isn’t it? You falter, but you pick yourself up.

A good product is useless if there are no users. How do I get the word out? How do I market TheNewSavvy.com to ensure that more women are aware that my product exists? This difficulty has been endlessly on my mind since I embarked on this journey - How do I make women more interested in financial literacy?

With so many roles you have to play, what is your secret to effective time management?

I don’t have a structured schedule as I travel a lot. In a start-up, you’ve to be good at multitasking as we don’t have the luxury of hiring many people. One day I would be busy scheduling meetings and some days, I will be focused on product development. I also focus on marketing, PR and growth. We get many invitations to be keynote speeches and panels but I am judicious on which ones we get on.

Every week, I always make it a point to set goals and priorities. I focus on what I want to achieve, what I need to clear and who I want/need to meet. I meet a lot of people and sometimes, it gets overwhelming as I have a high introversion personality. Working for your own start-up can be exhausting, so it’s important to get support. And when things get too much, I sit alone and get my me-time. I always make it a point to exercise and read. Those are my indulgences.

What are your personal goals for 2020?

I’m focusing on Gourmet Food Holdings and am personally excited to expand Mrs Pho and Tsuta, locally and globally. We hope to bring better cuisine and innovation in the F&B space. I also want to focus on rebuilding my health by exercising and sleeping more!

Any mantra to live by? Any tips or words of advice for fellow female entrepreneurs?

To be resilient. To always try, even at the risk of failure.

What are some financial tips you can give to our readers?

Most investors are currently searching for yields, be in equities, bonds, mutual funds or property. The current investment climate is heavily influenced by the political scene. For now, I will personally look into dividend stocks, blue chip stocks, ETFs and possibly, property.

1) Empower yourself financially through education and knowledge. Don’t be afraid, don’t invest blindly and never put your future or finances in someone else’s hands.

2) Always spend lesser that what you earn. It sounds very simple, but most of us tend to forget this.

3) Prioritize to save and invest your money early on in your career, especially while you have high earning capabilities. The earlier, the better to enjoy the power of compounding. And if you lack discipline, try automating your savings.

4) Focus on building an emergency fund. Make sure you have at least 6 months of savings for unforeseen circumstances.

5) Last, focus on healthcare and insurance. Make sure you are prepared for medical expenses and hospital bills. Get yourself covered as early as possible – especially when buying accident, health, retirement, and life insurances.

F O L L O W A N N A H A O T A N T O @ A N N A H A O T A N T O